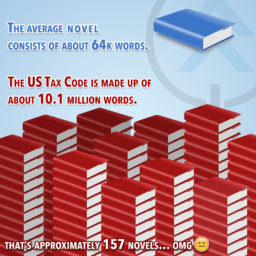

Amongst savvy investors, there has been growing interest in alternative investments with the stock market consistently reaching an all-time high for the past few years. Investors are attentively waiting for potential market adjustments and/or bear market coming. Additionally, investors are seeking investment options that are independent of the market as well as avoiding traditional bank products that are providing low-interest rates and government bonds that are high in price due to bonds having an inverse relationship with interest rates.

Compared to traditional investment options, alternative investments may carry different risk for being in different asset classes and not regulated by SEC, but dependent upon how it is incorporated into an investment portfolio, it may be a great option to lower overall risk from investing too heavily in one central asset class which allows diversification between different asset classes that may lead to potentially higher rate of return overall.

Let’s first define what alternative investments are:

- Non-traditional investments that are non-correlated to the market

- Investment in start-ups and private companies in exchange for equity or interest

- Non-registered private offering

To explain more in detail, some examples of alternative investments are:

- Hedge funds

- Venture capital

- Private equity

- Private placements

- Real estate notes

- Life settlement

- Oil and gas

With the various types of alternative investments that are available in the market today, there are markers to foresee which type of investment may be ideal for you. To begin, real estate notes/promissory notes may be suitable for investors seeking investment options specifically in real estate with collateral for a consistent flow of income. On the opposite side, a life settlement may be ideal for investors that are not in need of consistent income or liquidity from the investment. Life settlement investors are willing to set aside investment for a longer period of time for a potentially higher rate of return sometime in the future. This would be an option for those who do not have RMD requirements and do not have a need to withdraw income from the investment anytime soon. Like all investments, investors should only consider the investment amount that they can bear the risk of losing principal in case of an unforeseen situation.

A private equity, another alternative investment option, is nonpareil for savvy investors taking a specific interest in specific industries – technology, real estate, pharmaceutical, etc. – and belief in the hosting company to introduce innovative solutions and/or products. This alternative investment calls for a lengthier period before an investor can exit from the investment, so ideally, it is not well suited for investors seeking consistent and immediate income. Private equity is for investors that are looking for a significantly higher rate of return when the company goes public or merge or gets sold to a larger company. Although the return may be astronomical when a startup company becomes successful the risk entailing is whether the company will be able to make it or not. Therefore, an understanding of the type of industry and the specific company chosen to invest would be required before making an investment decision.

Many investors are familiar with conservative investment options – CDs, bonds, annuities – and more aggressive investment options such as stocks and mutual funds which may be as risky as some of the alternative investments in certain market conditions, however, they may be completely unaware that there are OTHER OPTIONS available in the market that may be more suitable for certain investors assuming their financial situation and investor’s investment personality. Now is the best time to learn about these non-traditional investment options and reach out to financial advisers that are well-versed in and know how to properly utilize alternative investment options to diversify risks and increase chances of earning an overall higher rate of return in the long run.