Cut taxes. Build wealth.

Picture this: Instead of sending a check to the IRS,

you use it to invest in your retirement.

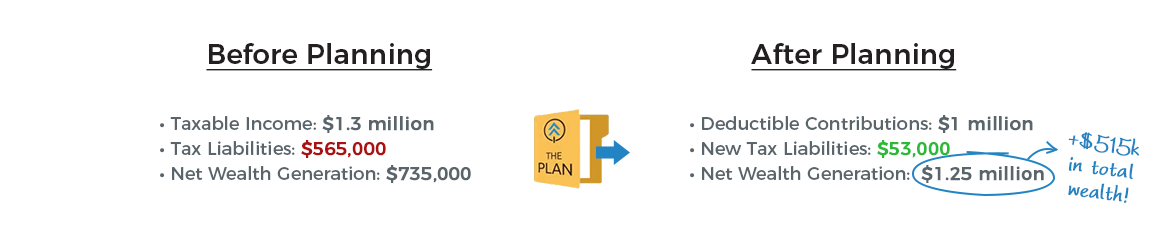

Here’s A Quick Look at John, A Business Owner

Pays $565k in taxes

12 employees

Wants to retire

Offers 401k

This client was referred to us by his CPA with the intention of reducing taxes and preparing for his upcoming retirement. With a few plans already in place,

he and his CPA were looking for additional ways in which to reduce his tax liability. Together, we utilized Advanced Planning to establish pre-tax pension

accounts that were used to fund multiple types of investments that all directly boosted his retirement wealth.

Want Results Like This for 2017?

If you’re a business owner in a similar situation to John, we may be able to help.

Answer the quick questions below and provide your contact information so we

can reach out to you with the best possible solution.

Not Sure If This Is For You?

Check out this 2 minute video that covers this Advanced Planning strategy

so you can make an educated decision to reach out to us.

Why Wait?

Feel free to contact us at any time to learn more and schedule your

complimentary consultation. We look forward to hearing from you!

info@profectusfinancial.com