Use “Pre-Tax Wealth Creation” to Grow Your Retirement Wealth

Eliminate tax liability by diverting funds

into wealth generating accounts

What is Pre-Tax Wealth Creation?

Pre-Tax Wealth Creation is the process of converting taxable business income sources to an asset protected tax-deferred “retirement trust” account. It is designed to achieve maximum tax deductions, minimum asset exposure, and maximum tax deferral growth. Pre-Tax Wealth Creation converts money that you would have paid in income taxes into your retirement wealth.

Strategies designed to reduce income taxes and increase your retirement wealth.

This IRS-permissible strategy is complicated and advanced. For proper execution, it requires a strong team with experience and refined knowledge.

We would work closely with your CPA or trusted tax preparer to ensure a complete understanding of the plan and investment options so that you would have confidence in executing the strategy. We are dedicated to walking through every step of the way to achieve maximum satisfaction.

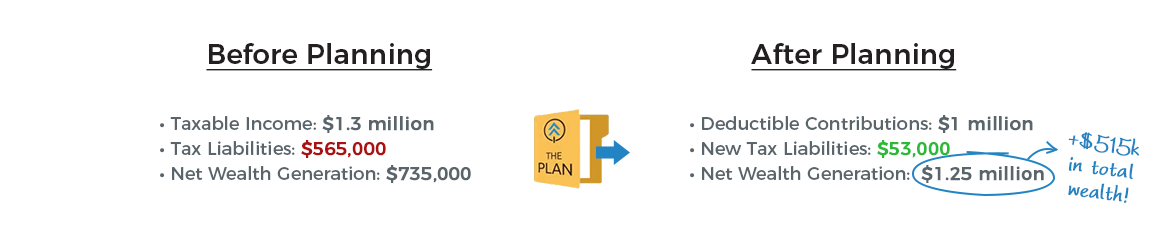

Here's a glance at a real business owner's financial situation

before and after implementing Advanced Planning.

(Spoiler alert: He saved over $500,000 in taxes)

Don't just take our word for it.

These are the examples of the types of businesses we work with. However, the range of eligible industries is more extensive.

TRUCKING

Tax saving achieved:

$250K – $1.8mil

Gross Revenue: $10mil – $100mil

# of employees: 25 – 200

MANUFACTURING

Tax saving achieved:

$250K – $1.8mil

Gross Revenue: $10mil – $100mil

# of employees: 25-100

GARMENT WHOLESALE

Tax saving achieved:

$250K – $2mil

Gross Revenue: $5mil – $60mil

# of employees: 25 – 200

EMPLOYMENT OUTSOURCING

Tax saving achieved:

$250K – $600K

Gross Revenue: $3mil – $15mil

# of employees: 25 – 200

DOCTORS/DENTISTS

Tax saving achieved:

$250K – $1mil

Gross Revenue: $1mil – $5mil

# of employees: 2 – 20

HOME HEALTH AGENCIES

Tax saving achieved:

$250K – $600K

Gross Revenue: $3mil – $15mil

# of employees: 25 – 200

ATTORNEYS

Tax saving achieved:

$250K – $1.4mil

Gross Revenue: $1mil – $7mil

# of employees: 2 – 20

CPAs/ACCOUNTING

Tax saving achieved:

$200K – $600K

Gross Revenue: $1mil – $3mil

# of employees: 5 – 20

Disclaimer: These average tax savings are in no way guarantees of future performance. Every case is different and we encourage you to talk with us and your CPA/accountant to get a better idea of how Advanced Planning can work for you.

Meet Aleksander Dyo

He’s an expert in advanced pension planning and business consulting.

Get to know us

Together, Aleks and Kelly co-founded and operate Profectus Financial with the common goal of helping business owners grow their wealth and accelerate their success. Experts in tax-saving strategies, they've helped hundreds of business owners save hundreds of thousands of dollars in taxes. Their industry-leading work in Advanced Planning design and implementation has earned them MDRT Top of the Table memberships for years running, as well as features in industry publications like Forbes and MDRT Magazine.

Meet Kelly Woo

She was featured in MDRT Magazine for her outstanding performance in the field.

Want to save big on 2018 taxes?

Our guess is yes, and we can help. We're offering a year-end financial consultation to help business owners learn how much they could be saving in taxes. The best part? It's totally free.

Request A Call

You can let us know what time of day works best for us to contact you.

Request An Email

We'll send you more information and let you know what steps to take next.

Don't feel like waiting?

We like your style. Feel free to contact us at any time to learn more and schedule

your complimentary consultation. We look forward to hearing from you!

800.811.6611

info@profectusfinancial.com