Split Annuity Strategy

When financial markets turn volatile, some investors show their frustration by fleeing the markets in search of alternatives that are designed to offer stability. For example, in April 2017, investors pulled $14.5 billion from U.S. stock funds based on uncertainty in Washington.1 For those looking for a way off Wall Street’s roller-coaster ride, annuities may offer an attractive alternative. Annuities are contracts with insurance companies. The contracts, which can be funded with either a lump sum or through regular payments, are designed as financial vehicles for retirement purposes. In exchange for premiums, the insurance company agrees to make regular payments either immediately or at some date in the future. Meanwhile, the money used to fund the contract grows tax deferred. Unlike other tax advantaged retirement programs, there are no contribution limits on annuities. And annuities can be used in very creative and effective ways.

Tip: Annuity sales reached nearly $211 billion in 2016, which is roughly equal to the GDP of Finland. Source: Insured Retirement Institute, March 30, 2017; The World Bank, 2017

The Split

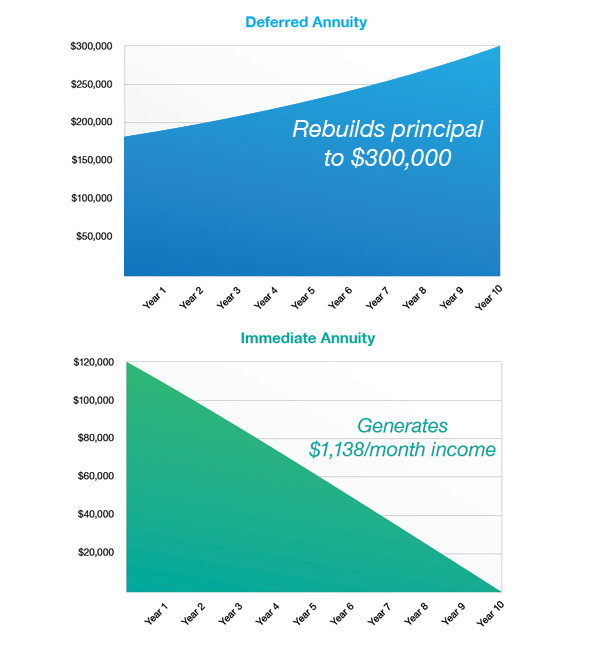

One strategy combines two different annuities to generate income and rebuild principal. Here’s how it works: An investor simultaneously purchases a fixed period immediate annuity and a single premium tax-deferred annuity, dividing capital between the two annuities in such a way that the combination is expected to produce tax-advantaged income for a set period of time and restore the original principal at the end of that time period. Keep in mind that any withdrawals from the deferred annuity would be taxed as ordinary income. When the immediate annuity contract ends, the process can be repeated using the funds from the deferred annuity (see example). Remember, the guarantees of an annuity contract depend on the issuing company’s claims-paying ability.

Diane Divides

Diane divides $300,000 between two annuities: a deferred annuity with a 10-year term and a hypothetical 5% return, and an immediate annuity with a 10-year term and a hypothetical 3% return. She places $182,148 in the deferred annuity and the remaining $117,852 in the immediate annuity. Over the next 10 years, the immediate annuity is expected to generate $1,138 per month in income. During the same period, the deferred annuity is projected to grow to $300,000 effectively replacing her principal.

Don’t Procrastinate

The earlier you can begin to communicate about important issues, the more likely you will be to have all the information you need when a crisis arises. How will you know when a parent needs your help? Look for indicators like fluctuations in weight, failure to take medication, new health concerns, and diminished social interaction. These can all be warning signs that additional care may soon become necessary. Don’t avoid the topic of care just because you are uncomfortable. Chances are that waiting will only make you more so.

Fast Fact: The state with the oldest population is Florida, with 19.06% of its population over the age of 65. Maine is second, with 18.24%. Source: WorldAtlas.com, January 6, 2016

Remember, whatever your relationship with your parent has been, this new phase of life will present challenges for both parties. By treating your parent with love and respect and taking the necessary steps toward open communication you will be able to provide the help needed during this new phase of life.

- U.S. Census Bureau, 2016

- Note: Power of attorney laws can vary from state to state. An estate strategy that includes trusts may involve a complex web of tax rules and regulations. Consider working with a knowledgeable estate management professional before implementing such strategies.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2017 FMG Suite.