Do Your Kids Know The Value of a Silver Spoon?

You taught them how to read and how to ride a bike, but have you taught your children how to manage money? One study of 2015 college graduates showed they had an average of $35,051 of college-related debt. And the share of those graduating with debt was about 70%.1 For current college kids, it may be too late to avoid learning about debt the hard way. But if you still have children at home, save them (and yourself) some heartache by teaching them the basics of smart money management.

Tip: Give Them a Look. Find a credit card calculator on the web to give your kids a real-life look at what it actually costs to “buy now, pay later.”

Have the conversation. Many everyday transactions can lead to discussions about money. At the grocery store, talk with your kids about comparing prices and staying within a budget. At the bank, teach them that the automated teller machine doesn’t just give you money for the asking. Show your kids a credit card statement to help them understand how “swiping the card” actually takes money out of your pocket.

Let them live it. An allowance program, where payments are tied to chores or household responsibilities, can help teach children the relationship between work and money. Your program might even include incentives or bonuses for exceptional work. Aside from allowances, you could create a budget for clothing or other items you provide. Let your kids decide how and when to spend the allotted money. This may help them learn to balance wants and needs at a young age when the stakes are not too high.

Fast Fact: Pass It On. 71% of current college students say they learned money management from their parents. Sallie Mae, Majoring in Money, 2016

Teach kids about saving, investing, even retirement planning. To encourage teenagers to save, you might offer a match program, say 25 cents for every dollar they put in a savings account. Once they have saved $1,000, consider helping them open a custodial investment account, then teach them to research performance and ratings online. You might even think about opening an individual retirement account (IRA). With the future of Social Security in question, your kids may be on their own to pay for their retirement. Some parents offer to fund an IRA for their children as long as they are earning a paycheck.2 As you teach your children about money, don’t get discouraged if they don’t take your advice. Mistakes made at this stage in life can leave a lasting impression. Also, resist the temptation to bail them out. We all learn better when we reap the natural consequences of our actions. Your children probably won’t be stellar money managers at first, but what they learn now could pay them back later in life when it really matters.

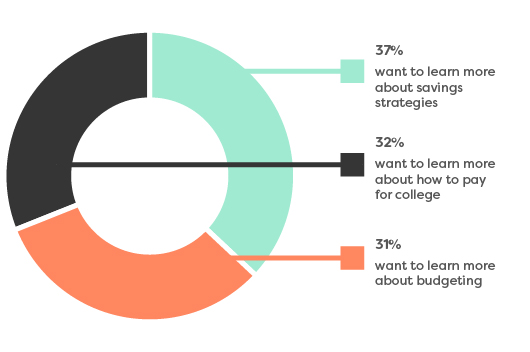

Tell Me About It

More than eight-in-ten college students say they want to learn more about specific aspects of managing money. Here’s what they want to know.

Chart Source: Sallie Mae, 2016

- CBS Market Watch, May 9, 2015

- Contributions to a Traditional IRA may be fully or partially deductible, depending on your individual circumstance. Distributions from traditional IRA and most other employer-sponsored retirement plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2017 FMG Suite.